BUSINESS

MARKET ANALYSIS

IS THE FUTURE TRAVEL BEHAVIOUR GOING TO BE AFFECTED BY COVID-19?

Today’s travel and lodging industry have been severely affected from the COVID-19 outbreak. Experts suggest that the virus will be the cause of the largest drawdown of demand since world war two (Mckinsey, 2020). There are many articles calling the end of the Hospitality Industry and travel as we know it and to a certain extent, they are right. People will be more precautions from now on with the choices they make. Jay Sorensen, president of IdeaWorks, talked exclusively to Forbes about his prediction on the market. His company is concerned with gathering data airlines, hotels, car rentals and other travel industry service providers. After doing so in April, Sorensen analysed the report and decided to give his glimpse to the future state of the world. He called travel to be globally generating 330 million jobs or 1 out of 10 jobs on Earth, being a ‘’very meaningful part of modern life’’. His introduction was assuring the reader form the beginning that: “People love to travel, and business people need to travel.” Therefore, he argued, “Travel will return again.”

Travel Growth

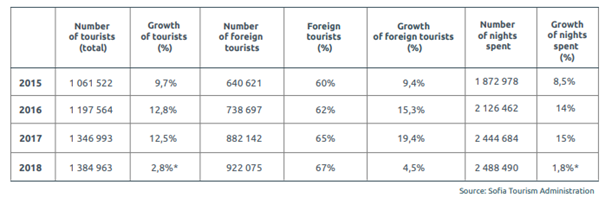

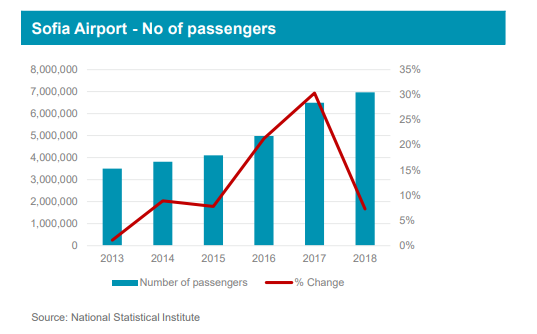

Until the pandemic outbreak, Sofia presented a steady travel growth through 2018. Cushman & Wakefield presented a graph illustrating the increase in No. of passengers that Sofia airport reportedly experienced. The number hit 6,96 million in 2018.

Hotel market in sofia

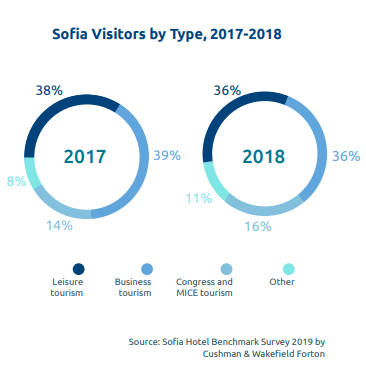

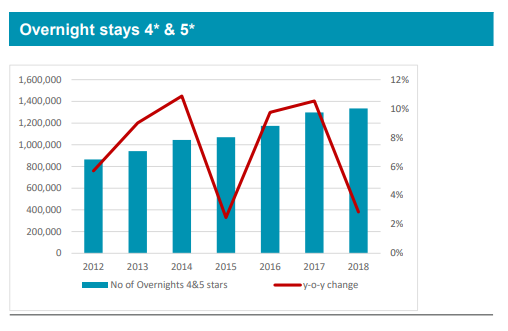

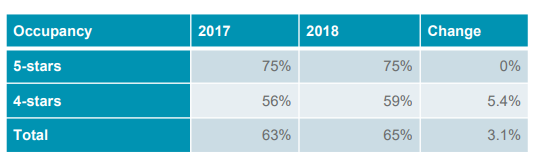

All in all, Cushman & Wakefield in collaboration with Forton reported for the year 2018 the upscale Hotel Market to have a 16% increased in Revenues. Sofia is typically a corporate hotel market due to it’s high demand for weekdays and lower overall results for weekends. The increase in Business and Mice tourism led to an important spike in foreign tourists traveling.

In 2018, 615,000 out of 767,000 travellers (80% of the total), who booked 4 to 5 star Hotels in Sofia were foreigners.

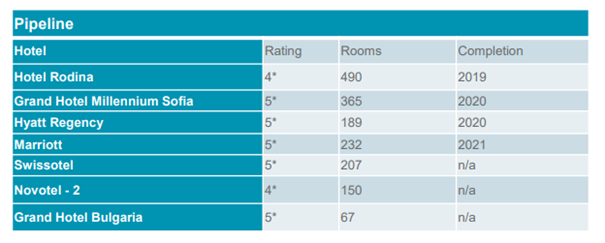

Key Performance Indicators compared to other major cities in Europe.

Key Indicators illustrate a significant lower performance for the Bulgarian Market in 2018. However, this is also affected by the low presence of international Hotel Chains and brands. This is due to increase the following years, predicted to enlarge the client base of Sofia and strengthen the position of Sofia overall.

PARIS

RevPar 170€

Occupancy 75%

LONDON

RevPar 141€

Occupancy 80%

SOFIA

RevPar 62€

Occupancy 75%

PRAGUE

RevPar 72€

Occupancy 80%

WARSAW

RevPar 58€

Occupancy 75%

Development activity

Consequent to the performance of the 5-star segment, the Pipeline reports showcase that the market for this segment, following the construction and opening of the proposed projects, will become saturated. The supply increase however is forecasted to increase competition in the high-end hotel market, driving occupancy and ADR growth potential.

Cushman & Wakefield Forton (2019) see great potential into the development in upscale and upper-midscale Hotels drawn by the lack of performance of the current existing competition and available demand.

WHY INVEST IN BULGARIA

Bulgaria also known as the oldest country in Europe is also famous for its natural diversity of plants, mountains, rivers, Black Sea Coast, lakes, hot Springs and rich culture.

-Access to key markets in the European Union, Russia, Turkey, China and the Middle East.

-6% annualized growth of tourist arrivals for the last 5 years outperforming the EU and the world average (4,6% and 4,3%) as well as competitors like Turkey, Italy and France.

-Projected growth of business and foreign visitor spending of 84% and 75% respectively by 2027 clearly surpasses the EU (27% and 48%) and the world average (49% and 58%).

-Balanced GDP composition with above average industry and tourism sector contribution, Germany is a major trade partner

-Government prioritises touristic activities

-All year round tourism, due to the four seasonality in Bulgaria

-Lowest cost of doing business in EU for both variable and fix costs (cost advantage for labor cost >80%, utilities ~30%, industrial and office rents between 68% and 82% compared to EU average)

-Lowest corporate tax rate of 10% flat in EU (compared to 15% in SRB, 16% in RO and 19% in PL and CZ)

-Business stability (2,4% GDP growth for 2020, 25th place in EU and 4th lowest gov. debt to GDP)